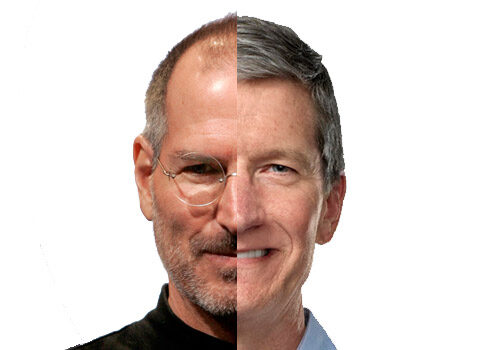

By now you’ve probably heard that Apple CEO Tim Cook announced this morning a plan to pay back cash dividends to its shareholders. It’s a big news story for Apple, but I think there’s a bigger one: this is Cook’s first big move that signals a change in Steve Jobs’ way of doing things. Where is Cook taking the company?

Steve Jobs famously did not run Apple the way other companies are traditionally run. He put an end to stock dividends when he returned to the company back in ’96, preferring to stockpile the company’s income in order to “build the future.” But Jobs is gone now, the company is insanely lucrative with more money than it knows what to do with, and arguably, paying out dividends is the logical, non-evil thing to do.

Others can speak to the dividend issue with far greater analysis and intelligence than I can. Financial issues such as the stock market are not my area of expertise, so I’m not going to embarrass myself by going on about that at length.

What interests me in all this is that it’s the very last thing Jobs would have done. There was a school of thought after Jobs died that suggested that the company might proceed forward with the operational mandate that’s summed up by the letters “WWSD.” What Would Steve Do? The thinking was that Apple’s enormous success and record-setting turnaround over the last fifteen years was mostly due to Jobs’ unconventional leadership methods and uncanny knack for predicting the future of technology. So it would make sense for Cook, his cadre of VPs, and the company’s board of directors to test every action they considered against the litmus test of whether or not it’s something Jobs would have approved of.

No one can think like Steve Jobs. He was an original. (He was also deeply flawed to the point of narcissism at times. He wasn’t perfect, and he wasn’t incapable of being wrong. However, the results he got cannot be disputed. But I digress.) So Apple is wise not to bother trying to predict whether their every move now is something their fallen leader would have done, were he still alive. That kind of endless second-guessing would spiral into madness, and stagnate the company.

On the other hand, that doesn’t mean they have to turn their back entirely on his methods and ideas. And this dividend thing today is a very big shift in Apple’s thinking. It is, frankly, exactly What Would Tim Do? This move today is a clear statement that there’s a new man in charge, that the Jobs era has ended, and that Tim Cook has no intention of trying to emulate his former boss. So I can’t help wondering where Cook is planning to take the company.

Is it possible that Cook’s different style of leadership and his “standard corporate America” methods are just what Apple needs at this point in its history? Sure. Anything’s possible. This is a pivotal moment in Apple’s story, a major shift, no matter how you slice it. But, Devil’s Advocate… The times that Apple made its mark on history were only the times when Jobs was in charge.

Cook will always be measured against the things he does that are congruent with Jobs’ methodology, and the things that he does that are different. He’s standing in the shadow of one of the most important CEOs in modern history, and he always will. Maybe he intends to find a balance between walking in Jobs’ footsteps, and leaving his own mark and legacy within the company. That would probably be the wisest approach he could take. Only time will tell if Cook proves to be as effective a leader as Jobs.

Let’s temper all opinions and predictions borne out of today’s announcement with this reminder: Tim Cook was Steve Jobs’ friend, confidant, and the man Jobs personally selected to run the company after he was gone. If he had Steve’s full confidence and trust, then shouldn’t that be enough for the faithful?

What do you think? Would Cook do well to break from Jobs’ way of doing things entirely, or should he try to mimic Jobs’ management methods as much as he can?

6 thoughts on “Is the Apple Stock Dividend Anti-Steve Jobs?”

I always remember what Tim Cook said was one of the last pieces of advice Steve gave him:

“Among his last advice he had for me, and for all of you, was to never ask what he would do. ‘Just do what’s right,'”

I don’t understand why shareholders would prefer to get 2usd a share every quarter when we’ve been making hundreds! We could have got Facebook and gain a huge advantage over android or in another year buy Google outright and fulfill Steve’s dream to end android. I wish I could understand why did Tim and some executives sold millions worth of Apple stock when all analysts are over-bully about Apple. Anybody can explain?

Hi. I’m a business analyst working for a rather prominent software company (no, not Microsoft)… and an Apple user since 1979.

I was personally opposed to the idea of dividends partly for the same reason, but coming specifically from a Buffett point of view: If I know that the company has sound management who can return increases in per share book value (not market price) better than the rate I could earn by investing dividends, essentially that they’re smarter than me at knowing how to make money with money, then I’d rather they keep the money. If not, I’d rather they pay me a dividend so no matter what happens to market price I still get paid as long as operations are turning any kind of positive cash flow.

But in Apple’s case, one thing concerns me, and that’s an analyst-driven bubble. Recently, Gene Munster of Piper Jaffray gave Apple a trillion dollar 12 month target valuation.

But if you actually run the analysis on it… and let’s be generous and count Apple’s $100 billion pile of cash that’s sitting and netting next to nothing by itself as part of their working capital and say it’s $105.2 billion in total net working capital. This may get heady for some readers but how it comes out the other end is that this company that did $37 billion in operating cash flow would have to suddenly generate a trillion dollars in operating cash flow for their one year target price to be around $1000.

That’s simply not going to happen unless Apple sold an iPad and an iPhone to every man, woman and child in China.

Given that Apple’s execs are probably a little wary about that valuation internally, I would say that the dividend was a smart move so if speculators ever come to their senses that all the vested RSU’s will still pay the senior management team handsomely, as well as the institutional holders who probably got on board when Apple was actually underpriced… and that’s happened a few times, but not at present.

Using discounted cash flow analysis and counting only working capital (net current assets) because all the fixed assets like property, plant and equipment don’t directly translate to operating cash flow, Apple’s present valuation is between $419 and $519 per share, depending on whether you count the $100 billion in cash or not (I wouldn’t).

On the flip side, despite whatever prudent analysis would tell you their actual value is at the present moment, institutional investors running hedge funds could drive the stock price well past its actual value. As Buffett famously said, “Price is what you pay. Value is what you get.”

The difference is that prop trading operations (which pass the Volcker rule because they’re not in conflict with the recommendations to clients) will have done prudent analysis and purchased shares of AAPL at prices well below its intrinsic value years ago, and make tons of money cashing out when hedge funds and asset managers for high net worth clients keep driving the price up by making buy recommendations at currently overinflated prices.

But because of the Volcker Rule, there now exists a situation in which the firm that used to profit by engaging in activity on both sides of this spread cannot. So the market maker manipulation that would have directly driven Apple’s stock into the stratosphere is somewhat limited.

I don’t think Apple’s executives are doing anything particularly unethical, but I would be surprised if they weren’t aware of these factors that make issuing a dividend a safer proposition in the event that some catastrophic market activity exposes the risk that speculators have worked into the market price of AAPL, which while an extremely profitable underlying operation, is also the one security that everyone and their dog is attentive toward… so to think that AAPL isn’t overpriced and exposed to significant speculation risk is simply perverse.

Putting an end to stock dividends in 1996 in order to rebuild the company was a great plan preparing it for the future; as you said.

I am not sure Cook is not handling things different; perhaps Apple has reached the desired level that Jobs foresaw, if so, Cook is only acting out on the wishes set in motion.

Steve Jobs trusted Tim Cook, and Tim Cook handled Apple during Steve Jobs time away for medical reasons. Steve hand picked Tim for a good reason it seems. Tim is doing a wonderful job it would seem so far.